Veterans’ disability compensation is a tax-free monetary benefit paid to Veterans with disabilities that are the result of a disease or injury incurred or aggravated during active military service. The benefit amount is graduated according to the degree of the Veteran’s disability on a scale from 10 percent to 100 percent (in increments of 10 percent). Compensation may also be paid for disabilities that are considered related or secondary to disabilities occurring in service and for disabilities presumed to be related to circumstances of military service, even though they may arise after service. Know about VA disability rates in 2024.

Aid and Attendance (A&A)in va disability rates 2024: – It is a higher monthly pension amount paid to a Veteran or surviving spouse.

Aid and Attendance is a benefit provided by the U.S. Department of Veterans Affairs (VA) that provides financial assistance to eligible veterans or their surviving spouses who require the aid and attendance of another person to perform daily living activities or who are housebound.

If a veteran or the surviving spouse of a veteran qualifies for the Aid and Attendance benefit, they can receive additional monthly compensation above and beyond the standard VA pension. This additional compensation is intended to help cover the costs of in-home care, assisted living facilities, or nursing home care.

To be eligible for Aid and Attendance, the veteran must have served at least 90 days of active military service, with at least one day during a period of wartime. Additionally, the veteran or surviving spouse must meet certain medical and financial criteria set by the VA.

The Aid and Attendance benefit is intended to assist veterans or their spouses who have significant care needs and may require assistance with activities of daily living, such as bathing, dressing, feeding, or managing medications. The benefit is designed to provide support to help them maintain a higher quality of life and receive the care they need.

It’s important to note that the specific eligibility criteria, application process, and benefit amounts may vary, so it’s advisable to contact the U.S. Department of Veterans Affairs or a Veterans Service Organization for accurate and up-to-date information regarding Aid and Attendance benefits.

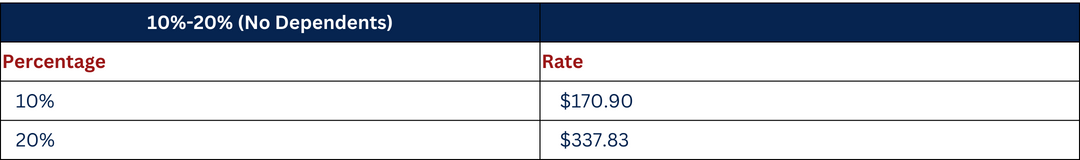

Compensation rates for Veterans with a 10% to 20% disability rating

Effective December 1, 2023

Note: If you have a 10% to 20% disability rating, you won’t receive a higher rate even if you have a dependent spouse, child, or parent.

Source: vadisabilitygroup.com

TABLE A

Compensation rates for Veterans with a 30% to 100% disability rating

Effective December 1, 2023

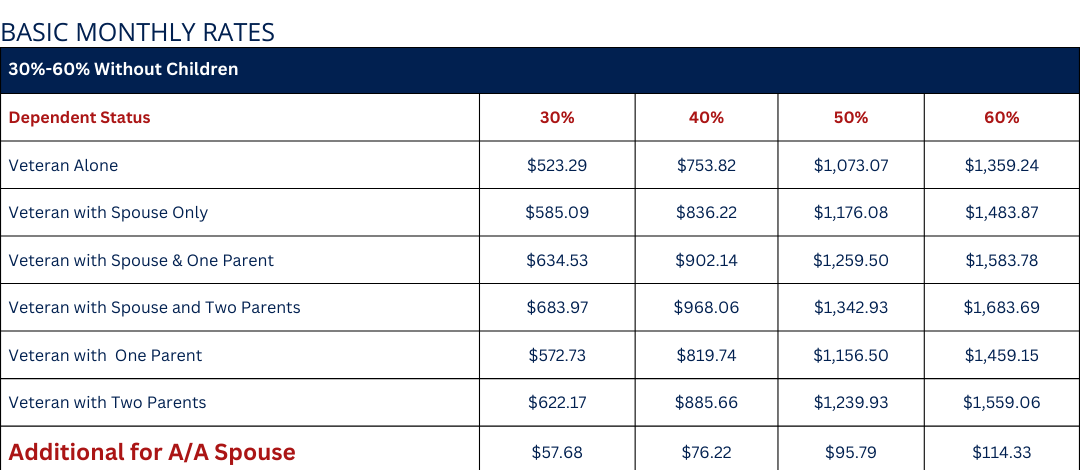

Compensation rates for Veterans with a 30% to 60% disability rating

Effective December 1, 2023

With a dependent spouse or parent, but no children

Your basic monthly rate is where your dependent status and disability rating meet.

If your spouse receives Aid and Attendance benefits, look at the Additional for A/A Spouse Row, and add it to your amount from the Basic monthly rates.

TABLE B I

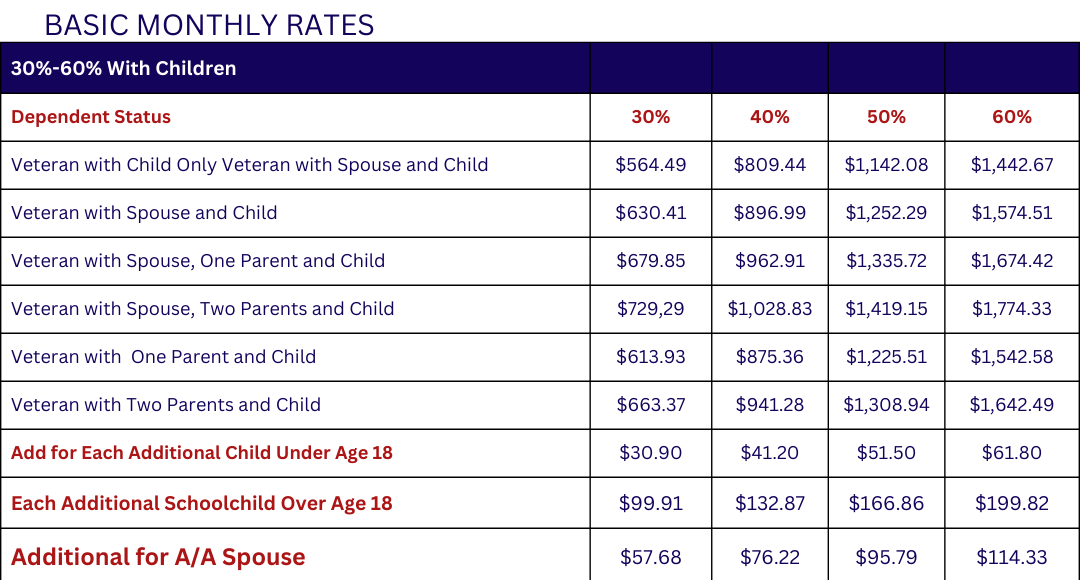

With dependents, including children

Your basic monthly rate is where your dependent status and disability rating meet.

If you have more than one child or your spouse receives Aid and Attendance benefits, look at the Additional for A/A Spouse Row, and add it to your amount from the Basic monthly rates.

TABLE B II

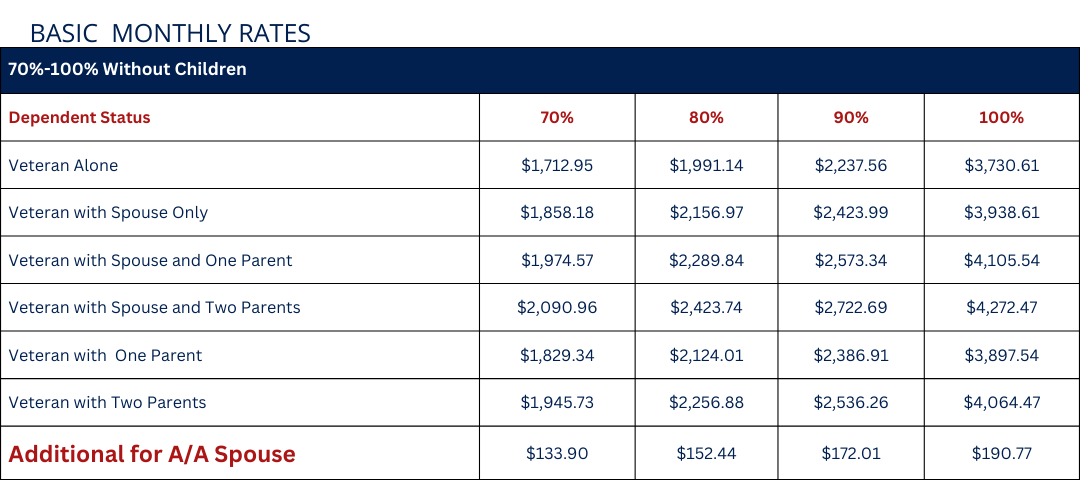

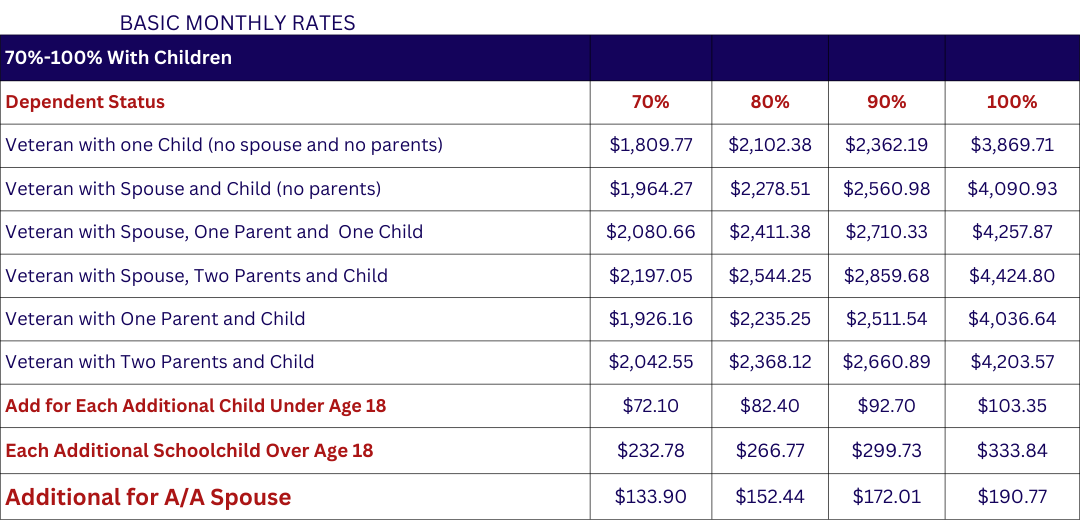

Compensation rates for Veterans with a 70% to 100% disability rating

Effective December 1, 2023

With a dependent spouse or parent, but no children

Your basic monthly rate is where your dependent status and disability rating meet.

If your spouse receives Aid and Attendance benefits, look at the Additional for A/A Spouse Row, and add it to your amount from the Basic monthly rates.

TABLE C I

With dependents, including children

Your basic monthly rate is where your dependent status and disability rating meet.

If you have more than one child or your spouse receives Aid and Attendance benefits, look at the Additional for A/A Spouse Row, and add it to your amount from the Basic monthly rates.

Table C II

Example for VA Disability Rates in 2024 (Veteran with children):

If you’re a Veteran with a 70% disability rating, and you have a spouse, plus 3 dependent children under the age of 18, you would start with the basic rate of $1,964.27(for a Veteran with a spouse and 1 child).

Next, look at the Added amounts table. Find the amount for children under age 18 ($72.10).

Since your basic rate already provides payment for 1 child, you would add the rate of $72.10 for each additional child (so $72.10 x 2).

If your spouse receives Aid and Attendance, you would also add $133.90 (which is the added amount for a spouse receiving Aid and Attendance, for a Veteran with a 70% disability rating).

In our example of a Veteran with 70% disability rating, your total monthly payment amount would be:

$1,964.27 basic rate (1 spouse, 1 child) (According to Table C II)

+ $72.10 (second child under 18)

+$72.10 (third child under 18)

+$133.90 (the spouse who receives Aid and Attendance)

Total $2,242.37

How VA Disability Compensation is Determined

Veterans Affairs (VA) Disability Compensation is determined through a process that assesses the extent and severity of a veteran’s service-connected disabilities. These disabilities could be physical injuries, mental health conditions, or chronic illnesses that the veteran developed during, or as a result of, their military service. Here’s how the process generally works:

- Filing a Claim: The process begins when the veteran files a claim with the VA. This claim can include medical evidence, military service records, and any other supporting documents that may help establish a connection between the veteran’s military service and their disability.

- Compensation and Pension Exam: After the claim is filed, the VA may request further evidence or medical examinations to help assess the severity and service connection of the disability. This is known as a Compensation and Pension (C&P) Exam.

- Rating Decision: The VA then uses all of the gathered evidence to make a “rating decision.” This decision determines the disability rating for each of the veteran’s service-connected conditions. These ratings are given in 10% increments, from 0% to 100%. The higher the percentage, the more severe the disability is considered to be, and the greater the monthly compensation the veteran is entitled to receive.

- Combined Ratings: If a veteran has more than one service-connected disability, the VA uses a special method to calculate the combined disability rating. It’s important to note that this is not a simple mathematical addition of the ratings for each condition. For example, a veteran with a 50% rating for one condition and a 30% rating for another does not necessarily have an 80% combined rating. The VA uses a specific formula to determine the combined rating based on the idea that each subsequent disability rating is applied to an already disabled person.

- Compensation Amount: Finally, the VA uses the combined disability rating to determine the amount of monthly compensation a veteran is entitled to receive. This amount also varies depending on whether the veteran has dependents (such as a spouse, children, or dependent parents).

Source: vadisabilitygroup.com

Know more about VA disability rates in 2023.

You must be logged in to post a comment.